New cars cost money, which means that not everyone can afford one, as unfortunate as that may sound. Yet many Canadians who cannot afford a car still go right ahead and buy one anyway. How is such a thing possible? Two reasons – loans and impulse shopping. According to a recent survey for Consolidated Credit Counseling Services, 35 per cent of Canadians said that their largest source of consumer debt was buying on impulse. Meanwhile, the average length of a car loan in the country has reached 72 months. If that’s not enough, some dealers offer loans lasting for as long as 96 months, which plays directly into our terrible impulse-buying habits.

So, how do we change this? Well, we could stop being impulsive and start being honest with ourselves regarding our finances. Here’s how to tell for sure whether a car – new or used – is within your reach:

1. Evaluate Your Budget

The obvious first step is, well, obvious… Take a look at your budget and make sure that none of your current expenses would interfere with your car payments.

According to CAA, the average Canadian spends $9,500 per year on a compact vehicle, which amounts to about $792 per month. This is a rather hefty amount, especially if you consider the fact that a larger and more luxurious vehicle will probably cost you even more. And to put things in perspective, Statistics Canada estimates that the average Canadian spends far less on groceries – $5,400 a year, to be exact. So, the only thing that seems to surpass the cost of car ownership is home rental or mortgage.

This means that you need to check if you can squeeze that extra $792 into your current budget. And before you say that you wouldn’t need to pay that much anyway because you won’t use your car often, slow down, because the cost of gas isn’t the only vehicle expense. Consumer Reports states that financing (plus interest), insurance and depreciation account for the majority of vehicle expenses. In other words, even if you never drive your car, it will still cost you money.

So, take a careful look at your income and spending habits. As of December 2014, the average salary in Canada is just over $49,000, which is more than enough to afford a car. In fact, even if your earnings are not at this level, you should still be able to handle monthly car payments, especially if you live by yourself or only with your significant other.

Use budgeting software like Quicken to nail down your daily expenditures and see if there is room for more. If not, then make a few cuts – especially if you are overspending on things like entertainment or food (and Quicken will let you know if you do). If you have managed to make room for at least $500 a month, then there is hope for you yet.

2. Make a List of Cheap Cars

Let’s assume that your budget is as tight as it can be ($500 or less). This means that you can only afford two things – an old used car or a small new car. Be warned that a cheap, old used car may end up costing you more in the long run due to additional repairs and maintenance. And in some cases, repairs can cost thousands of dollars, so if you are not prepared for that, you may suddenly lose your driving privileges along with the money to get them back. On the other hand, cheap new cars with lots of features are becoming increasingly prevalent. In fact, many of them are far more “luxurious” than their older counterparts, so you may want to give them a look first.

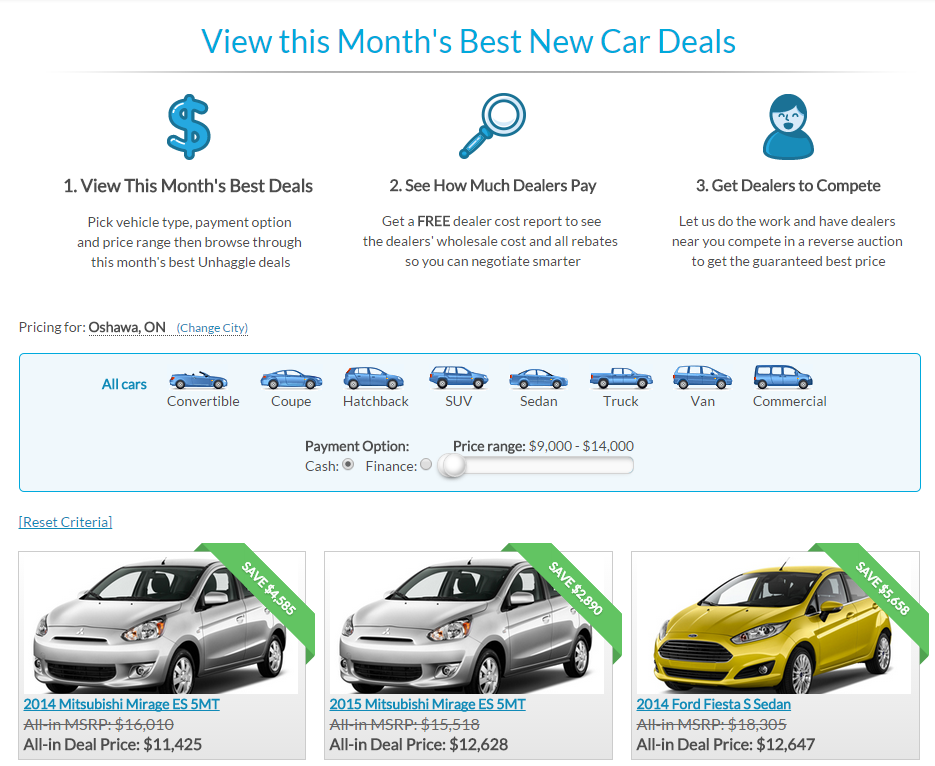

To create a list of cheap cars, pick your preferred vehicle type and set your budget with our special deals tool and you should be good to go:

Once you have about 10 of them selected, check them out on review sites like Autofocus.ca or Wheels.ca to see if they are any good.

3. Calculate How Much It Will Cost to Own

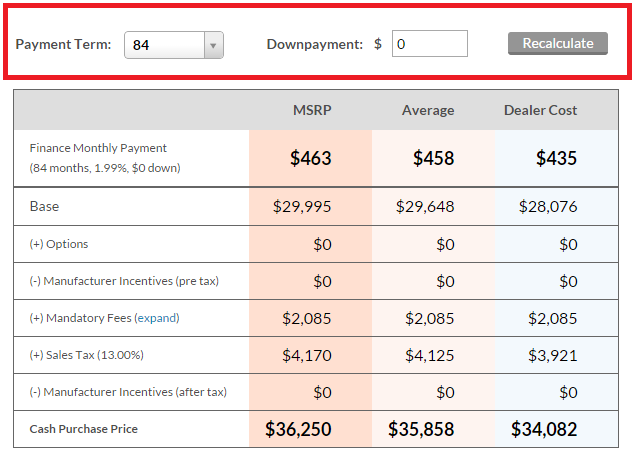

After checking out the cheap cars you have discovered, it’s time to calculate if you can afford to own them. This means that you should know your monthly payments. First, check how much each vehicle you have picked will cost you to finance by using the monthly payment calculator within our free dealer cost report:

Then use a tool on RateLabe.ca to calculate your potential insurance payments and configure your car on CAA.ca to find out how much it will cost you in fuel. If you want to be REALLY thorough, be sure to check out how much the car will depreciate over the course of your ownership period on CanadianBlackBook.com.

Add all the expenses up and you should have a fairly good idea of how much you will have to spend on the car. If it falls within your allocated amount, then you are set!

4. Not Enough? Do the Following…

If the amount doesn’t quite add up, then you have to go back to the drawing board. You have several options:

A) Make more budget cuts in Quicken until you are able to afford a car.

B) Buy a used car that costs even less than the cheapest new car – in which case be sure to account for repairs.

C) Start earning more money! This is obviously a tough one, but there are several tips on how to get a raise at your current job or find better employment opportunities elsewhere.

No matter what your current financial circumstances are, don’t let them stop you from finding a way to own a car – just make sure you don’t buy one if you can’t really afford it!

For more information on car prices, consult our free dealer cost report.