Understanding how to navigate the trade-in process can save you time, money and frustration. Whether you are thinking about selling your old vehicle yourself or trading it in when you buy your new car, here is what you need to know.

Private Sales

Although you may be able to sell your car for a higher price privately, the associated costs and time commitment can make you think twice. Here are the steps you need to take:

1. Used Vehicle Information Package (UVIP): Obtain a UVIP from the Ministry of Ontario which costs $20. By Ontario law, a seller must provide buyers with the UVIP. The UVIP includes a description of the vehicle, registration history, outstanding debts or liens on the vehicle, the vehicle wholesale price, as well as a bill of sale. If you live outside of Ontario, check with the provincial ministry for details on the applicable laws.

2. Safety & Emissions: When selling your vehicle privately you are responsible to make sure your vehicle passes safety and emissions tests. There is also the chance that if your recently sold car breaks down you may be legally responsible if the buyer decides to pursue damages. When you trade-in your vehicle to a dealer you absolve yourself of liability.

3. Determine Price: Once you’ve completed any repairs that may be needed, you need to determine a fair price for your vehicle. As a starting point, use Canadian Black Book which provides a value range for your car. You can also check local used car listings to find comparable vehicle pricing, but keep in mind the listings show only the seller’s asking price and actual transaction prices can be meaningfully lower as a result of negotiations and discounts.

4. Advertise: You will then have to advertise your vehicle either online through services such as Auto Trader or in local print publications. Keep in mind that you will have to make yourself available to show your vehicle to prospective buyers.

5. Sales Tax: When you sell your vehicle, sales tax will still need to be paid when the title is transferred (HST of 13% in Ontario). The sales tax is payable on the greater of the actual sale price and the Canadian Red Book value or wholesale price which is outlined in the UVIP. Therefore, even if you sell your vehicle below wholesale price, the buyer will still have to pay tax on the wholesale price. For example, if you sell a used vehicle that has a wholesale price of $10,000, the buyer will need to pay sales tax of $1,300 in Ontario when he or she transfers the title, even if you sold for less. Buyers will factor this into their price negotiation with you. The only situation when sales tax is exempted is when the vehicle is being given as a gift between close family members.

Here is some more information about selling a used car in Ontario from the Ontario Ministry of Transportation.

Dealer Trade-ins

Trading in your old vehicle with a dealer provides you with convenience as well as significant tax savings.

Do not appraise your trade-in before you settle on the price of your new car.

It is always recommended that you settle on the price of the new vehicle before you discuss the price of your trade-in. This prevents the dealer from “playing with the numbers” to give the appearance of a great trade-in value with a smaller discount on the new car (or vice versa). The best approach is to let Unhaggle find the dealer with the best price on the new car and then use Canadian Black Book as a guideline to ensure you get fair value for your trade-in.

1. Hassle Free: The dealer’s offer price will usually always be lower than what you can sell for privately as it has to include margin for repairs, marketing costs, sales commission, as well as some profit for the dealer. However, once the dealer takes over your trade-in, you have nothing else to worry about since they are responsible for preparing it for re-sale.

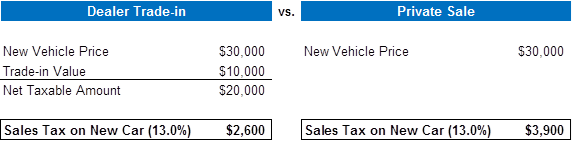

2. Tax Savings: There are significant tax savings available when trading-in your vehicle. If your new vehicle price is $30,000 and the dealer gives you $10,000 on your trade-in, you’ll only be required to pay tax on the difference of $20,000. Therefore, if you were to sell your car privately you would have to sell it for at least an additional $1,300 to make it equivalent to the dealer offer, and that does not include the additional time commitment required or potential necessary repairs. See the example below which demonstrates the tax savings.

Example tax savings on new car with a dealer trade-in

You save $1,300 in taxes with a dealer trade-in in this example

3. In-and-Out: Another benefit of going the dealer trade-in route that many people are not aware of is an “in-and-out” transaction. If you have a family member or friend that would like to buy your old car from you, take it to the dealer to get your tax savings, tell the sales person that you would like to do an “in-and-out” transaction and they will then sell the vehicle back to your family member or friend at the cost they acquired it from you.