Fuel economy, finance rates and fancy features top the list of concerns for many potential car buyers. However, for some it’s the eventual loss of value – or depreciation – that’s the main concern. The realization that no one but you will pay the same price for this very car again can hit you like a truck.

Depreciation is essentially the difference between the price you pay and the amount you get when you try to trade it in or sell it. Whether you’re buying a new car or a used one, its value will inevitably decrease. The most significant depreciation happens in the first three to four years at an average rate of 15 to 20 per cent a year. Click here to learn more about depreciation and how it affects the value of your car. Because of its inevitability, we believe that depreciation shouldn’t be feared, but embraced instead. Here’s how:

View Your New Car as a Good, Not an Investment

When you purchase a new 80-inch television, the thought of how much it will be worth in a few short years is a small concern, because ultimately it will be worth less than the price you pay for it. After all, it’s only a consumer good that you’ll likely use strictly for pleasure, either by catching the latest football game or

watching a shiver-inducing thriller.

The same attitude should be applied when purchasing a new car. Investing in a new car is more similar to investing in an education, new wardrobe or even time. These investments are made with hopes of adding value and perhaps capital to your life, but they are not made with the same promise that an investment in stocks or real estate provides. If you are looking to invest with a car, invest in adventure by purchasing a Jeep Wrangler. Invest in time spent with your family on road trips in your Toyota RAV4. Invest in decreasing your carbon footprint by purchasing a Toyota Prius. Instead of focusing on the return on investment that your car will never deliver anyway, see how it can enrich your life on a more personal level.

Why New Cars Depreciate So Quickly

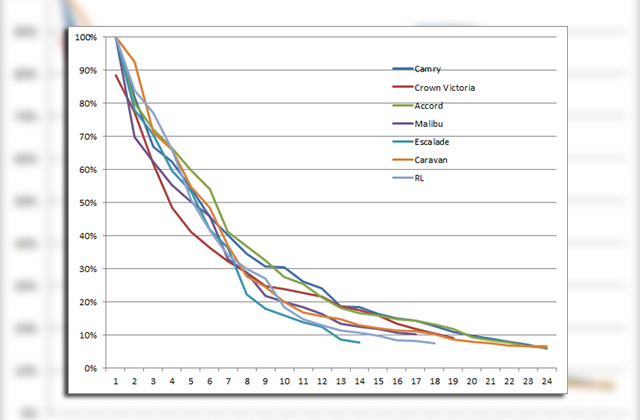

As soon as a new car leaves the dealer lot, it is valued at 11 per cent less, not five kilometers back. New cars depreciate at a rapid rate in the first three to four years, most significantly in year one. The primary reason for this is that the car is no longer new. When you go to sell this car, the pool of purchasers is narrowed to dealerships — who will not pay more than the lowest price they can potentially get that car for elsewhere. Your other potential purchasers are used car buyers — who will likely refuse to pay the inflated price you may ask for.

However, this does not mean that a used car that has already suffered its first-year value blow is a better choice. For starters, assuming you take a one-year-old model, you are saving only the 17 per cent you would have lost if you bought it new. The used car is only mildly used, but it has kilometers on it, a year of warranty is gone, and its value will continue to drop. At the very least, the depreciation premium, which is the 17-per cent loss suffered in the first year of owning a new car, buys you a peace of mind. You are guaranteed new parts, a full warranty, perfect maintenance and a clean vehicle history. While there are resources available that allow access to vehicle history, nothing is as trustworthy or accurate as the knowledge that you are the first person to drive that car. This kind of comfort is priceless.

When Depreciation Doesn’t Matter (and When It Does)

There are a few instances when you are looking at cars to buy where depreciation doesn’t matter or may be less relevant. When you purchase a new car with the intention of driving it into the ground (however long that may take), the concern of depreciation in value is irrelevant. There is no need to worry about the value of the car if you never intend to sell it in the first place. Another instance is if you plan on driving past your term of finance. If the car is paid off and you continue to drive it free of monthly payments, the money you are saving on payments will be earned back in depreciation. The rate of deprecation lessens significantly over time, with the residual value usually balancing around 40 per cent. Manufacturer rebates and dealer discounts are another way to save big on depreciation. Since deprecation starts at the MSRP (Manufacturer Suggested Retail Price), not the actual price you pay, you can actually avoid the dreaded first year of depreciation altogether. You just need to cut 15 per cent off the MSRP, which you can do by haggling with the dealer.

With that being said, there will always be cases when depreciation does matter and being aware of those is important. If you intend to have a very short-term purchase of three years or less, you will encounter disproportionate depreciation for little monetary value over the short-term. If you intend to keep your vehicle for a short time (three years or less), a better option would be to lease a new car. Taking on low down-payment financing can also be risky when it comes to depreciation. If your borrowing amount is high when you drive off the lot, you may have something called an upside-down loan – a loan that is higher than the worth of the vehicle. This can be problematic if you encounter a situation where you were to crash your car before balancing out your loan. The issue, however, can be managed through insurance companies that offer gap insurance by protecting your loan margin.

How to Slow Down (or Avoid!) Depreciation

It should be clearer by now what depreciation is and more importantly why new car buyers should not fear it, but rather embrace it. Part of embracing it can mean learning how to manage it. Slowing down depreciation can be done before a new car is even purchased right through to the years after the finance loan has been paid off. The following are some quick suggestions on how to do this:

1. Choose a workhorse car brand that is known to depreciate in value at a slower rate

(Japanese brands such as Toyota and Honda often top this list)

2. Investigate which car features, such as colour, are popular in used vehicles and add those into your new car purchase to bump up its resale value

3. Purchase your new car as far below the MSRP as possible to balance out that steep first year depreciation percentage

4. Complete regularly-scheduled maintenance and keep all service records